Electric Vehicles Credit Irs . Those who buy new electric vehicles may be eligible for a tax credit of up to $7,500, and used electric car buyers may qualify for up to $4,000. Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. You can claim the credit. To assist consumers identifying eligible vehicles, the department of transportation and department of energy published new. We'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit based on whether you. A federal ev tax credit is here, thanks to the inflation reduction act (ira) — massive tax and climate legislation promoting. New in 2024, consumers can also opt.

from www.templateroller.com

We'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit based on whether you. New in 2024, consumers can also opt. Those who buy new electric vehicles may be eligible for a tax credit of up to $7,500, and used electric car buyers may qualify for up to $4,000. Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. A federal ev tax credit is here, thanks to the inflation reduction act (ira) — massive tax and climate legislation promoting. To assist consumers identifying eligible vehicles, the department of transportation and department of energy published new. You can claim the credit.

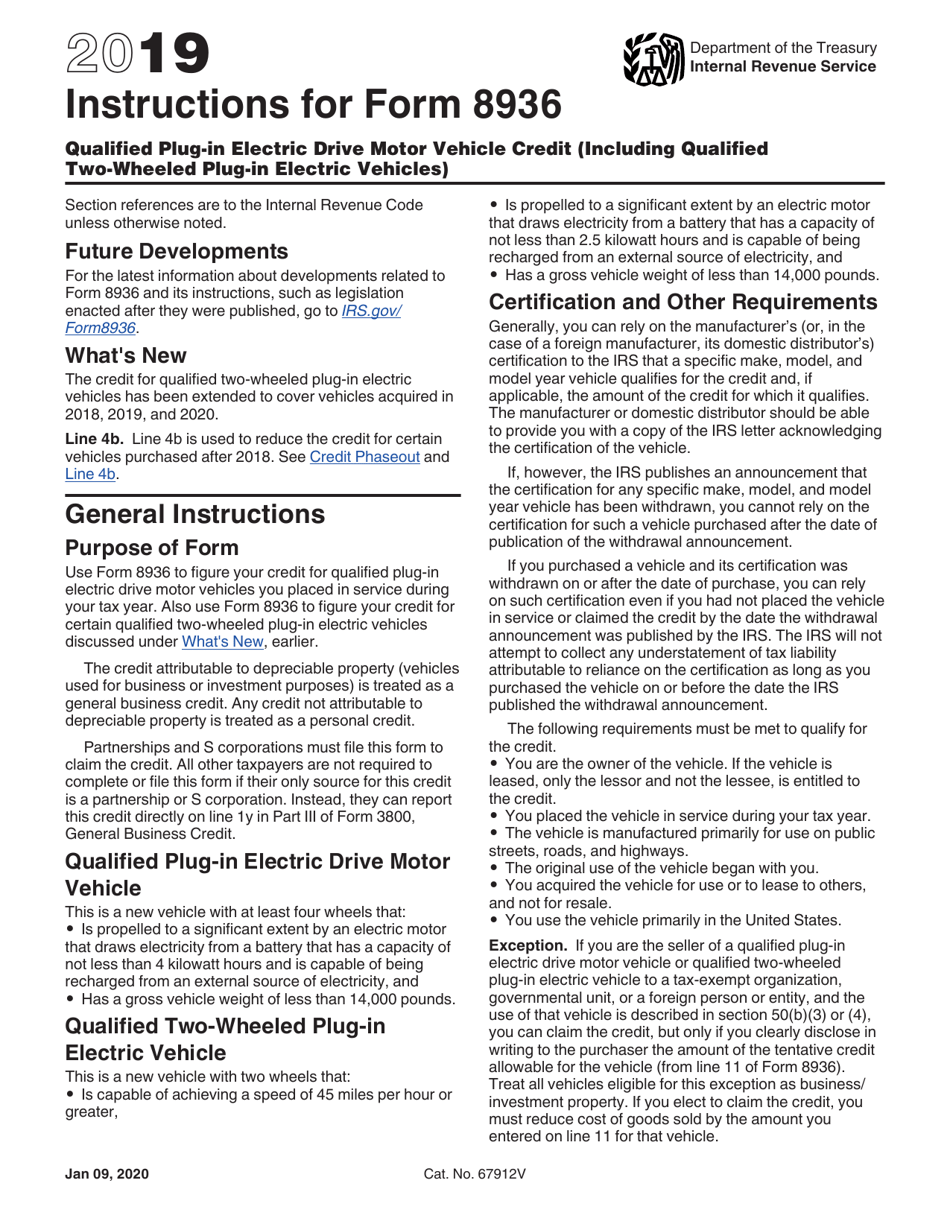

Download Instructions for IRS Form 8936 Qualified PlugIn Electric

Electric Vehicles Credit Irs Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. A federal ev tax credit is here, thanks to the inflation reduction act (ira) — massive tax and climate legislation promoting. We'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit based on whether you. To assist consumers identifying eligible vehicles, the department of transportation and department of energy published new. New in 2024, consumers can also opt. You can claim the credit. Those who buy new electric vehicles may be eligible for a tax credit of up to $7,500, and used electric car buyers may qualify for up to $4,000.

From turbo-tax.org

Have A New Electric Car? Don't To Claim Your Tax Credit! Turbo Tax Electric Vehicles Credit Irs We'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit based on whether you. Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. New in 2024, consumers can also opt. To assist consumers identifying eligible vehicles,. Electric Vehicles Credit Irs.

From www.digitaljournal.com

Americans can get 7,500 off these EVs this year—is it enough to sway Electric Vehicles Credit Irs New in 2024, consumers can also opt. To assist consumers identifying eligible vehicles, the department of transportation and department of energy published new. You can claim the credit. Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. We'll help you determine whether your purchase of an electric vehicle. Electric Vehicles Credit Irs.

From patrick-wilson5959.blogspot.com

2021 electric car tax credit irs Ngoc Schafer Electric Vehicles Credit Irs We'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit based on whether you. A federal ev tax credit is here, thanks to the inflation reduction act (ira) — massive tax and climate legislation promoting. Tax credits up to $7,500 are available for eligible new electric vehicles and. Electric Vehicles Credit Irs.

From lvhj.com

Maximize the General Business Credit, IRS Section 38 Lindquist, von Electric Vehicles Credit Irs Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. We'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit based on whether you. New in 2024, consumers can also opt. To assist consumers identifying eligible vehicles,. Electric Vehicles Credit Irs.

From dodiabenoite.pages.dev

Irs List Of Qualified Electric PlugIn Vehicles Images Elly Cinderella Electric Vehicles Credit Irs To assist consumers identifying eligible vehicles, the department of transportation and department of energy published new. You can claim the credit. Those who buy new electric vehicles may be eligible for a tax credit of up to $7,500, and used electric car buyers may qualify for up to $4,000. Tax credits up to $7,500 are available for eligible new electric. Electric Vehicles Credit Irs.

From www.greentecauto.com

Your Next Electric Car by Google? Electric Vehicles Credit Irs To assist consumers identifying eligible vehicles, the department of transportation and department of energy published new. Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. You can claim the credit. A federal ev tax credit is here, thanks to the inflation reduction act (ira) — massive tax and. Electric Vehicles Credit Irs.

From www.forbes.com

IRS Fails To Stop Electric Car Tax Credit Cheats Electric Vehicles Credit Irs We'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit based on whether you. To assist consumers identifying eligible vehicles, the department of transportation and department of energy published new. You can claim the credit. Tax credits up to $7,500 are available for eligible new electric vehicles and. Electric Vehicles Credit Irs.

From electricvehiclesmedzukibu.blogspot.com

Electric Vehicles Irs Tax Credit For Electric Vehicles Electric Vehicles Credit Irs You can claim the credit. Those who buy new electric vehicles may be eligible for a tax credit of up to $7,500, and used electric car buyers may qualify for up to $4,000. Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. A federal ev tax credit is. Electric Vehicles Credit Irs.

From www.templateroller.com

Download Instructions for IRS Form 8936 Qualified PlugIn Electric Electric Vehicles Credit Irs You can claim the credit. To assist consumers identifying eligible vehicles, the department of transportation and department of energy published new. New in 2024, consumers can also opt. We'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit based on whether you. A federal ev tax credit is. Electric Vehicles Credit Irs.

From www.agfintax.com

Tax Credits for Electric Vehicles The Latest from the IRS AG FinTax Electric Vehicles Credit Irs To assist consumers identifying eligible vehicles, the department of transportation and department of energy published new. New in 2024, consumers can also opt. We'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit based on whether you. You can claim the credit. A federal ev tax credit is. Electric Vehicles Credit Irs.

From www.theautopian.com

The IRS Is Making It Way Too Confusing To Buy An EV With Tax Credits Electric Vehicles Credit Irs A federal ev tax credit is here, thanks to the inflation reduction act (ira) — massive tax and climate legislation promoting. To assist consumers identifying eligible vehicles, the department of transportation and department of energy published new. Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. Those who. Electric Vehicles Credit Irs.

From bender-cpa.com

Tax Credits for Electric Vehicles The Latest from the IRS Electric Vehicles Credit Irs A federal ev tax credit is here, thanks to the inflation reduction act (ira) — massive tax and climate legislation promoting. Those who buy new electric vehicles may be eligible for a tax credit of up to $7,500, and used electric car buyers may qualify for up to $4,000. We'll help you determine whether your purchase of an electric vehicle. Electric Vehicles Credit Irs.

From www.okenergytoday.com

Push underway in Kansas to create more EV tax credits Oklahoma Energy Electric Vehicles Credit Irs To assist consumers identifying eligible vehicles, the department of transportation and department of energy published new. A federal ev tax credit is here, thanks to the inflation reduction act (ira) — massive tax and climate legislation promoting. New in 2024, consumers can also opt. You can claim the credit. We'll help you determine whether your purchase of an electric vehicle. Electric Vehicles Credit Irs.

From latinamcneal.blogspot.com

Latina Mcneal Electric Vehicles Credit Irs Those who buy new electric vehicles may be eligible for a tax credit of up to $7,500, and used electric car buyers may qualify for up to $4,000. Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. A federal ev tax credit is here, thanks to the inflation. Electric Vehicles Credit Irs.

From www.msn.com

IRS updates electric vehicle tax credits again Electric Vehicles Credit Irs To assist consumers identifying eligible vehicles, the department of transportation and department of energy published new. We'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit based on whether you. Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible. Electric Vehicles Credit Irs.

From www.formsbank.com

Fillable Qualified Electric Vehicle Credit 2007 Form 8834 printable Electric Vehicles Credit Irs Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. A federal ev tax credit is here, thanks to the inflation reduction act (ira) — massive tax and climate legislation promoting. New in 2024, consumers can also opt. You can claim the credit. To assist consumers identifying eligible vehicles,. Electric Vehicles Credit Irs.

From www.youtube.com

Electric Vehicle Tax Credits on IRS Form 8936 YouTube Electric Vehicles Credit Irs A federal ev tax credit is here, thanks to the inflation reduction act (ira) — massive tax and climate legislation promoting. Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles. New in 2024, consumers can also opt. You can claim the credit. We'll help you determine whether your. Electric Vehicles Credit Irs.

From johnmccarthycpa.com

Electric Car Credits 2023 Edition John McCarthy, CPA Electric Vehicles Credit Irs You can claim the credit. We'll help you determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a tax credit based on whether you. To assist consumers identifying eligible vehicles, the department of transportation and department of energy published new. New in 2024, consumers can also opt. A federal ev tax credit is. Electric Vehicles Credit Irs.